The company has undergone rapid growth in recent years and is transforming raw data into meaningful insights to deliver superior business outcomes.

THE CHALLENGE

The client is India’s only payments company with multichannel transaction processing capabilities through web, mobile, in-store or at the time of delivery. The company has a payments platform solution to manage payments automation, consumer credit distribution and SME lending, which has become a benchmark in their markets. They also have an expanding portfolio of merchants that they work with, extensively.

The company sought to implement a solution that would help them derive in-depth insights into the behavior of merchants and determine the various reasons for the churn. In addition, the company also wanted to formulate a plan to proactively act on customers who were likely to get churned.

THE SOLUTION

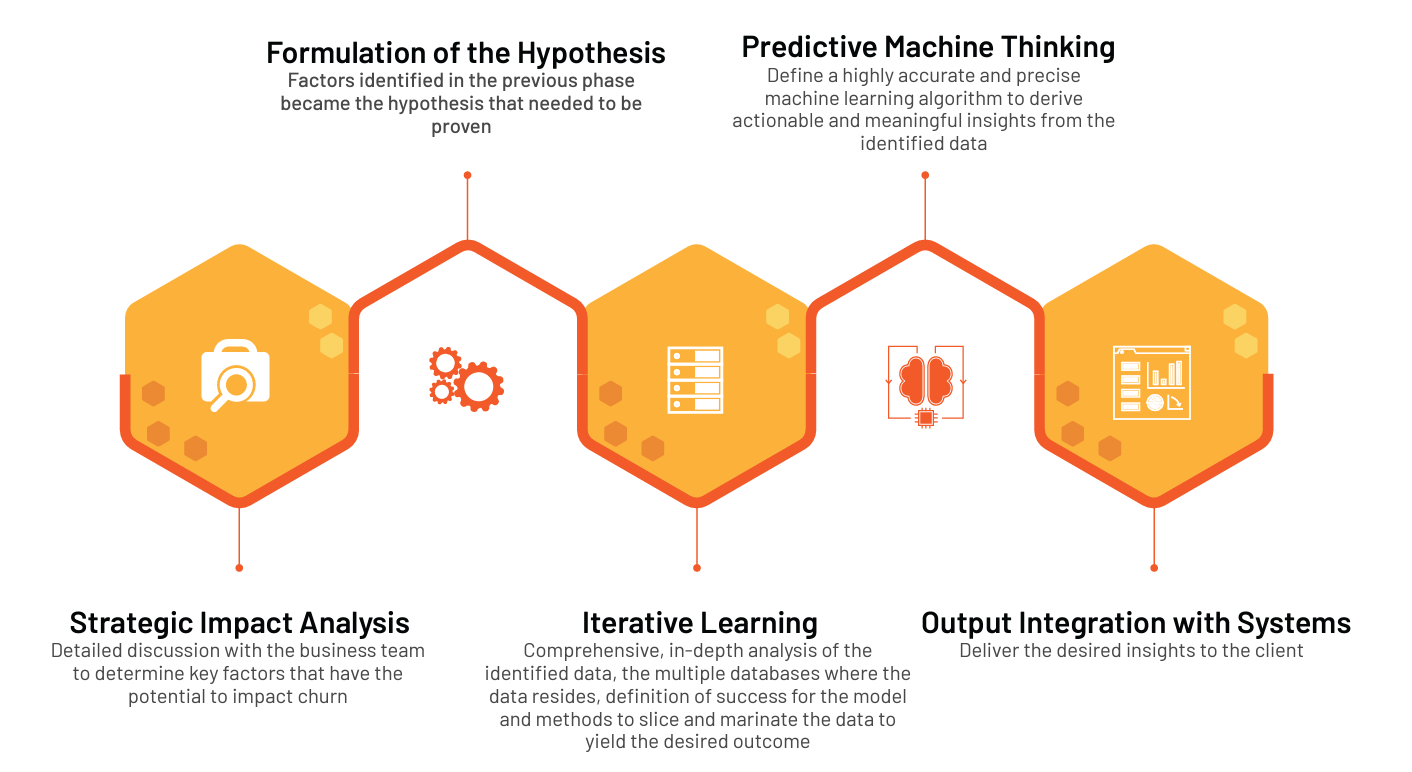

It is a known fact that retaining existing customers is a more cost-effective proposition than acquiring new customers. Hence, Prescience charted out the following methodology to enable the client to curb its extensive customer churn-out rate.

THE IMPACT

By implementing such a robust and advanced solution, the client is now able to take timely steps to address the issue of churn. Engagement with the merchants and stores have now became more meaningful with conversations being done around the specific factors identified for each merchant. In addition, the implementation of the model has also resulted in the reduction of churn through proactive measures, enabling the company to channel all its time, effort and resources to drive sales and business growth.